Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

[email protected]

603.230.4219

01/23/2025

Buy the Magnificent 7, rinse & repeat

Market observers saw the same movie in 2024 as they did in 2023 with large-cap U.S. stocks leading the way. Certainly, some small-cap stocks performed very well over the year; however, the ten largest companies, which represent only 2% of the S&P 500, continue to dominate the index. Through November, the mega-cap stocks accounted for 36% of index market capitalization and 25% of operating income. The so-called Magnificent 7 stocks accounted for 55% of the S&P performance in 2024, down modestly from 63% in 2023. It wasn’t a smooth ride for all of the mega cap stocks: Tesla was down 14% through mid-October before finishing the year up more than 60%. Small cap stocks, as measured by the Russell 2000 Index, rallied to a lesser extent and have managed to post two consecutive years of double-digit returns, recouping losses from the 2022 bear market.

| Index Price Gain | Local Currency | U.S. Dollar Return |

| S&P 500 | 23.31% | 23.31% |

| S&P 500 Equal Weight | 11.05% | 11.05% |

| S&P Top 50 ETF | 32.45% | 32.45% |

| NASDAQ | 28.81% | 28.81% |

| Russell 2000 Small Cap | 10.09% | 10.09% |

| MSCI EAFE | 0.35% | 0.35% |

| French CAC 40 | -2.14% | -8.21% |

| German DAX | 18.85% | 11.65% |

| UK FTSE 100 | 5.65% | 3.83% |

| Japanese NIKKEI | 19.22% | 6.84% |

| China Hang Seng | 17.67% | 18.34% |

| Bloomberg Commodity | 0.12% | 0.12% |

| U.S. Corp Bonds (includes interest) | 2.13% | 2.13% |

The S&P 500 closed 2024 a few percentage points below its December high; very close to the level it traded at the end of October. The dichotomy between the gains of U.S. large stocks versus global markets over the last two years is notable. We attribute the better performance to relative political stability and better economic growth as funds have flowed into the U.S. from abroad. Many of the developed international economies are experiencing slower growth or, like Germany, are teetering on recession. The inflow of foreign currency has also bolstered the U.S. Dollar. With the exception of the Chinese Yuan, major currencies have devalued relative to the dollar in 2024. U.S. citizens recently traveling overseas have enjoyed the favorable exchange rates.

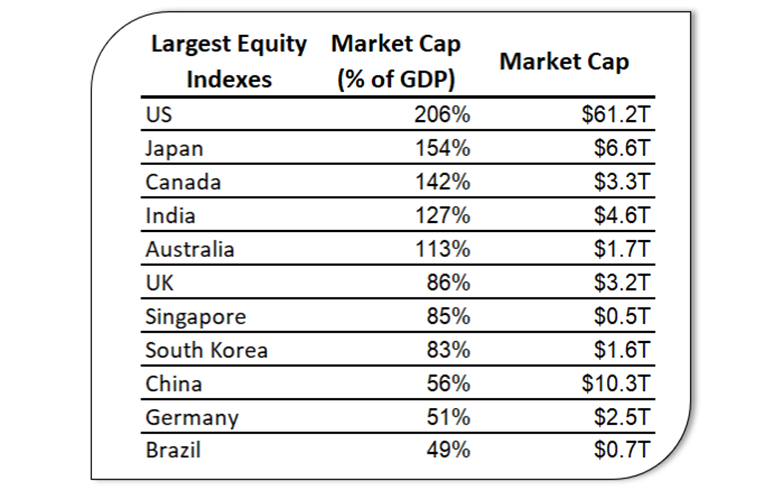

Equity market performance surprised many Wall Street strategists who began the year with a cautious outlook and called for slower U.S. economic growth, and possibly a recession. Many strategists also expected global markets to perform better than the U.S. because international stocks are trading at a cheaper valuation, and they looked for the dollar to weaken. Instead, the S&P registered 57 closing record highs and the NASDAQ Composite recorded 36 new highs. As seen in the chart below, U.S. stocks are now trading at twice the value of our Gross Domestic Product which is historically high.

The Federal Reserve and Interest Rates

We started the year with a Fed Funds target rate in the range of 5.25%- 5.50%, and the yield on the 10-year U.S Treasury note was 3.95%. Most Wall Street strategists predicted five or six interest rate cuts by the Fed during the year based on their respective models of a slowing economy and weaker labor market, expecting the 10-year Treasury yield to fall below 3.5%. Occasionally, the adage that the Market will fool most of the people at inopportune times proves to be true. Beginning in September, the Fed made three interest rate cuts totaling 100 basis points bringing the Funds rate down to 4.25%- 4.50%. Since the September Fed Funds rate cut the yield on the 10-year Treasury has moved in the opposite direction, rising by 100 basis points, to finish the year at 4.57%. Likewise, mortgage rates have risen to 6.9% at year end.

Outlook for 2025

Household wealth gained approximately 11% in 2024, much of that from rising real estate and stock prices, and now exceeds $170 trillion. This magnitude of increase supports consumption and spending, and GDP has risen at a 3% annualized rate since March. The healthy economy is keeping unemployment low, corporate profits growing and wages rising by 4%. One issue of concern is the fact that the bearish Wall Street strategists, who remain employed, have capitulated and have joined the chorus for higher prices in 2025. On average, the experts predict the S&P to close in a range of 6300- 6400, portending a price gain of 7%- 9%. Some of the bullish analysts, who have been more accurate in the last two years, expect gains in excess of 12% in 2025.

We remain invested at a normal allocation to equities based upon a stable U.S. economy, favorable earnings outlook and the continuation of the Fed’s rate-cutting cycle. We recognize that current valuations among some stocks and sectors can lead to increased short-term volatility based on news reports and exogenous events, and we maintain diversification across industries and asset classes in our effort to mitigate portfolio swings.

One year ago, our message to you was that while 2024 may prove to be interesting and unique, we ultimately expected it to be a good year for both stock and bond markets based on strong earnings and falling inflation. Although inflation has declined, intermediate bond rates have been a see-saw throughout the year. While we won’t attempt to predict where rates will be in twelve months, we have taken the opportunity to add to bond maturity ladders where appropriate as rates have increased. For now, it appears that bond investors are less concerned about inflation and more concerned about the magnitude of U.S. Treasury issuance to fund Federal spending. Rates may continue to rise until this concern eventually fades.

We look forward to continuing to serve you in 2025. Please update us with any changes in the new year.

Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

[email protected]

603.230.4219

Steve Smith, CFA®

Senior Vice President

Wealth Advisor/Strategist

[email protected]

603.230.4209

Dona G. Murray

Senior Vice President

Wealth Advisor

[email protected]

603.527.3936

Paul R. Zepf, CFA®

Vice President

Wealth Advisor

[email protected]

603.527.3234

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |