Here’s to Your Wealth – Tax Questions ‘Cheat Sheet’

01/01/2024

The start of a new year brings new tax adjustments to things like brackets, capital gains, and contribution limits. This article can be your one stop cheat sheet for the most common tax questions.

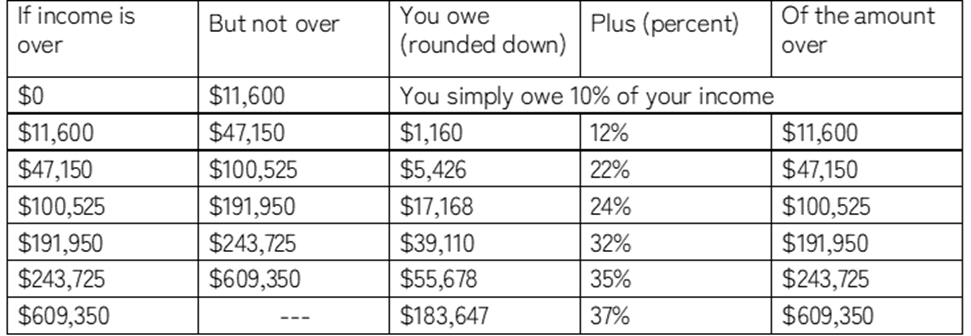

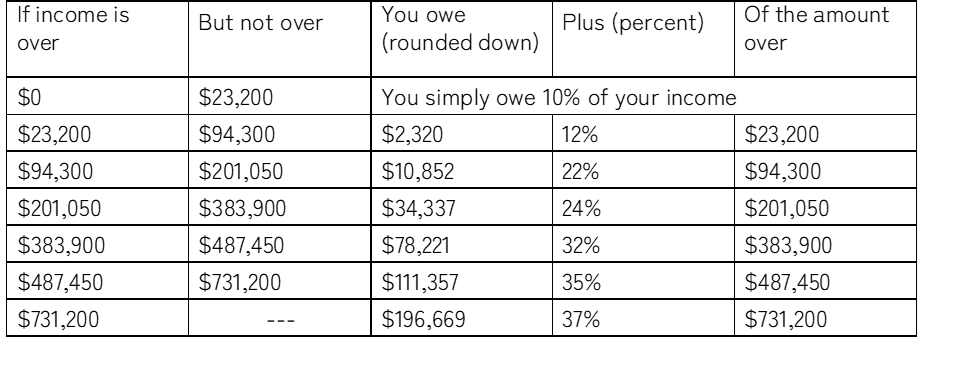

2024 Federal Income Tax Brackets

Single Payer:

Married Filing Jointly:

A key point to remember is that our income tax system is progressive. Therefore, if you file married filing jointly and your taxable income is $100,000 the 22% is not applied to the full amount. Rather, the tax owed would be calculated as follows:

10% of the first $23,200 = $2,320

12% on the dollars between $23,200 and $94,300 = $8,532

22% on the dollars between $94,300 and $100,000 = $1,254

Tax owed: $12,106

In this example, your marginal tax rate is 22%, but your effective tax rate is 12,106/100,000 which comes to 12.1%.

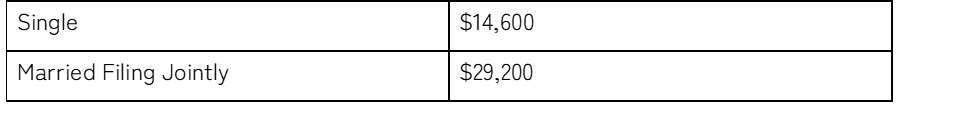

2024 Standard Deduction

Using the above example, the $100,000 income would be reduced to $70,800 when the standard deduction is applied. The tax owed would be reduced to $8,032.

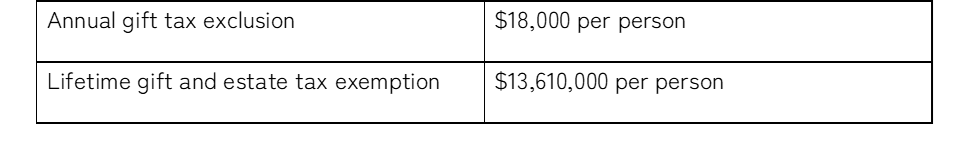

2024 Estate and Gift Tax Exclusion

In 2024 each tax payer can give up to $18,000 to anyone they wish without using up any of their lifetime gift and estate tax exemption. A married couple can combine to give $36,000 per recipient. Also, they can each shield $13,610,000 from estate taxes for a combined $27.22 million.

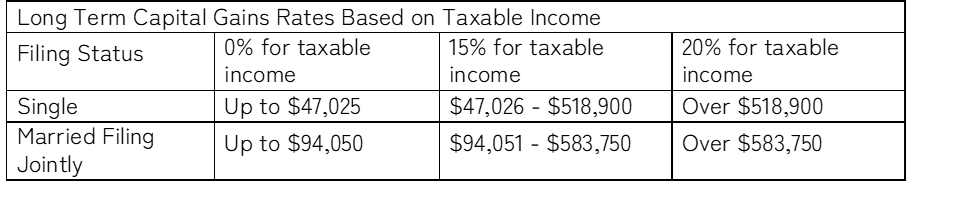

2024 Capital Gains Tax

- Gains from assets held for more than one year are taxed at long term capital gains rates.

- Gains from assets held for less than one year are taxed at ordinary income rates.

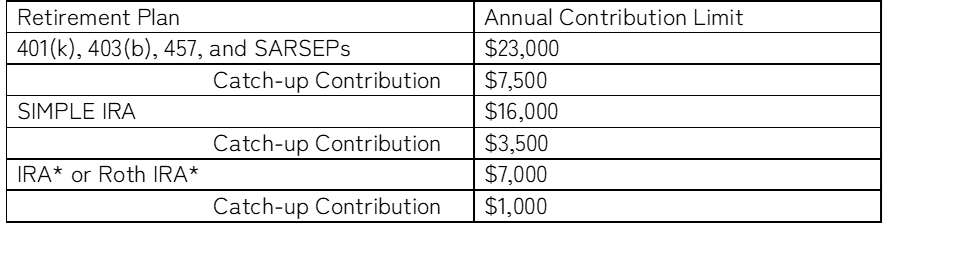

Retirement Contribution Limits

*Deductibility phases out based on you modified adjusted gross income.

Keeping your tax professional and wealth advisor updated is crucial for optimizing tax strategies, adjusting investments to align with financial goals, ensuring legal compliance, managing risks, and addressing life events that impact estate planning. Regular updates enable proactive solutions, help avoid legal issues and ensure that your financial plan remains effective and tailored to your evolving circumstances.

Disclaimer: Please note that we are not tax professionals, and the information we provide is for general informational purposes only. While we strive to provide accurate and up-to-date information, it is important to consult a qualified tax professional for specific advice regarding your individual tax situation. Any reliance you place on the information provided is therefore strictly at your own risk.

This material is intended for informational/educational purposes only and should not be construed as tax, legal or investment advice. We make no representation as to the completeness or accuracy of information provided at these websites. Please consult with your financial professional and/or a legal or tax professional regarding your specific situation and before making any investing decisions.

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |