Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

603.230.4219

09/04/2025

Investment Insights

| Index | 2025 Year-to-Date Price Appreciation |

|---|---|

| S&P 500 INDEX | 5.50% |

| DOWJONES INDUSTRIAL AVERAGE | 3.64% |

| NASDAQ COMPOSITE INDEX | 5.48% |

| EUROPE, AUSTRALASIA AND FAR EAST | 18.23% |

| BLOOMBERG AGGREGATE BOND INDEX* | 4.02% |

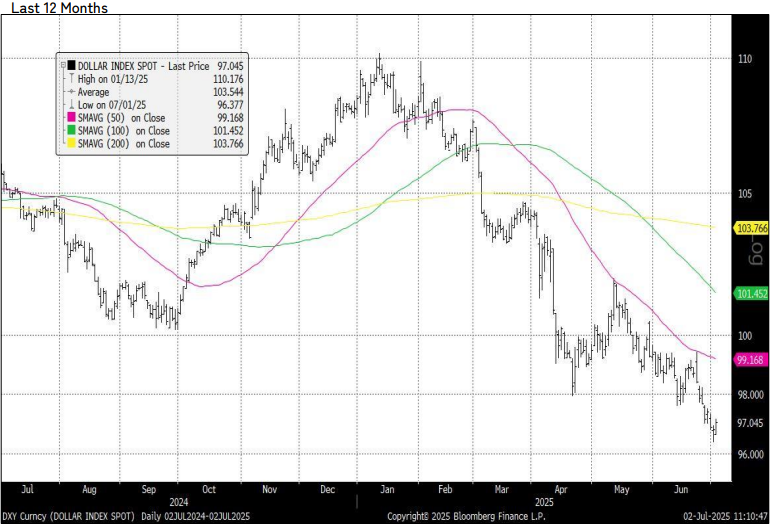

| U.S. DOLLAR INDEX | -10.47% |

| *Net Price Change Plus Interest | Source: Bloomberg |

The market had numerous headline news obstacles to overcome thus far in 2025. In spite of the tariff war, the Mid-East war, the ongoing Ukrainian war and the war on the Ivy League, large-cap indices have rebounded from April lows to reach record highs. Bonds also provided positive returns as the yield on the U.S. 10-year Treasury fell from 4.57% to 4.23%, despite a ratings downgrade for all treasury securities by Moody’s Corp in May.

The stock market has primarily focused on the potential impact of tariffs on both consumer spending and corporate profits. Thus far there is no imminent sign of recession or collapse in corporate earnings. S&P index earnings per share grew 7.2% through March, even as GDP fell .5%, and earnings are estimated to increase by 5% through June, concurrent with a rebound in GDP growth. The market expects the administration to reach a resolution with most major trading partners. Many trade negotiations seem to have successfully concluded and are awaiting confirmation by the Commerce Department or the White House. Given that 70% of domestic spending is on services and not subject to tariffs, the impact on the economy from 10%- 20% baseline tariffs on imported goods appears to be manageable. As trade finance goes, a $12 pair of sneakers imported from southeast Asia may add $2.40 to the price of a popular brand of athletic shoes that retail for $100 in the mall. The impact to the consumer on imported automobiles and other big-ticket items will admittedly be greater, as intended.

International stocks performed well in 2025 after lagging the U.S. market for more than fifteen years. The majority of the better performance can be attributed to the recent decline of the

Dollar. The trade-weighted value of the Dollar rose from $73 in 2011 to $114 in 2022. Since the end of covid, currency traders have been predicting the Dollar’s decline. Following a drop of 10.5% since year-end, the trade-weighted U.S. Dollar Index is approaching its long-term average level of $90.

In April investors were concerned that tariffs may lead to stagflation, a condition detrimental to the market value of financial assets. Although consumer spending has become increasingly selective, it is not declining. In the absence of an increase in business inventory levels, it is premature to forecast a recession. As for inflation, the Personal Consumption Expenditures Price Index (PCE) rose 2.3% year-over-year in May and is approaching the Fed’s annualized target of 2%. Fed Chair Powell stated in Congressional testimony they expect the effect of tariffs on prices will be reflected by July, leading to speculation the Fed will consider an interest rate cut in their September meeting if prices remain stable. Investors have become more sanguine on inflation fears, as evidenced by the recent drop-in interest rates. Although private payrolls unexpectedly declined in May, the unemployment rate remains at the lower end of the historical range, at 4.1%. For this reason, we do not expect the Fed to take any action on interest rates at their July meeting.

The market has shifted its focus from tariffs to Fed watching and attempting to handicap the timing and number of interest rate cuts. We feel the market will continue to ignore political rhetoric, protests, the news media and social media, and focus on business and economic fundamentals, as it typically does. The domestic economy continues to grow and U.S. assets and the Dollar, remain in demand globally. Following several weeks of higher volatility, equity and bond markets have resumed their normal trading pattern and we believe stocks can continue to work their way higher as earnings continue to grow.

Your goals are our priority and are always available to discuss any concerns or changes that arise.

Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

603.230.4219

Steve Smith, CFA®

Senior Vice President

Wealth Advisor/Strategist

603.230.4209

Dona G. Murray

Senior Vice President

Wealth Advisor

603.527.3936

Paul R. Zepf, CFA®

Vice President

Wealth Advisor

603.527.3234

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |