Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

603.230.4219

01/06/2026

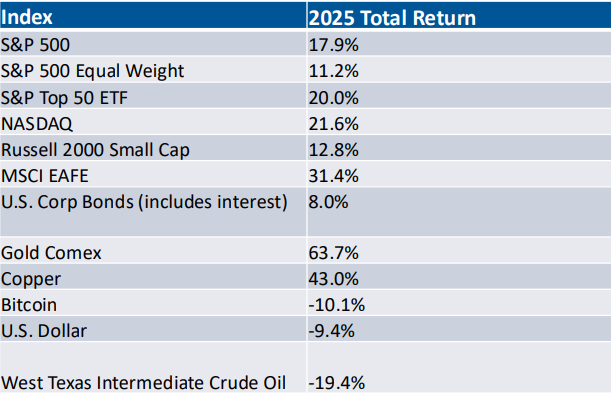

2025 marked the third consecutive year of double-digit returns – only the sixth such occurrence since the 1940s. The most recent stretch lasted five years during the late-1990s Dot-Com era. Artificial intelligence themes carried on from 2024 with many technology stocks continuing to perform well although other industries including banks and discount retailers also enjoyed strong results as market leadership broadened out. For the first time since the global financial crisis in 2008, international markets outperformed their U.S. indices as investors realized profits and rebalanced into attractively valued foreign equities.

One of the larger surprises during the year was “Liberation Day” on April 2nd when President Trump announced baseline and reciprocal tariffs. Another was the powerful rally in gold which was largely driven by foreign central bank purchases.

Although the likelihood of new tariffs became clear in the weeks prior to the announcement, the uncertainty around the new rates culminated in a 19% decline in the S&P 500 and almost 23% in the NASDAQ Index. Indeed, Gross Domestic Product (GDP) during the quarter ended March 31 declined by 0.5% as imports were accelerated to avoid tariffs. By the end of June, the market had determined the economic impact would be far less than the large tariff numbers printed in the headlines, and stock indexes surpassed the previous highs set in late-February. GDP rebounded to a 3.8% increase in the second quarter and rose by 4.3% in the third

quarter, surprising Wall Street economists, as consumer spending and exports grew above expectations.

Gold, up more than 26% in 2024, rose an additional 63% in 2025 as global central banks continued building reserves to hedge U.S. Treasury exposure amid concerns about currency debasement stemming from pandemic-era monetary expansion. Silver, along with many other industrial metals, has lagged the move in gold for more than a decade. In 2025, silver jumped almost 145% narrowing some of the gap.

Crude oil prices weakened during the year reflecting both a more favorable government policy towards domestic production, as well as ample global supply. Lower prices do not benefit earnings of major oil companies, as evidenced by their languishing stock prices. However, consumers and the economy at-large do benefit.

In response to a weakening labor market, the Fed lowered the Fed Funds interbank rate three times for a total of 75 basis points ending in a target rate of 3.50%- 3.75%. The unemployment rate increased from 4.0% in January to 4.6% by November as employers continued to adjust payrolls following the pandemic. The Fed has moved from a restrictive policy to a neutral policy in the past two years when the rate was 5.50%. We anticipate at least two additional cuts in 2026 based on labor weakness even as inflation remains above target. We note that Chairman Powell’s term expires in May, and his successor is unlikely to resist the President’s suggestion of lower rates.

Recap and Outlook for 2026

2025 heralded Warren Buffett’s announcement that he was stepping down following a phenomenal 70-year investment career, passage of the 900 page ‘Big, Beautiful Bill’, California surviving wildfires, floods and an L.A. riot following the Dodgers’ World Series win, the release of hostages held in Gaza, the end of the Lincoln penny and profit-taking in Bitcoin and other cryptocurrency. Meanwhile, NVIDIA became the first corporation to reach a $4 trillion market capitalization in July and surpassed $5 trillion in October.

Clients and colleagues alike have pondered if markets reflect reality of what’s going on in America and in the world. In truth, markets typically focus on economic reality and expectations of future prosperity. Stocks generally sell-off during times of uncertainty or catastrophic news events and then stabilize once the consequences of the event can be quantified.

The U.S. economy remains healthy, corporate profits continue to rise and wages are keeping pace with- or slightly exceeding- inflation.

There is no question that lower-income earners continue to struggle with higher costs including electricity rates which have increased more than 25% since 2019 in some locations. For the last two centuries, education has been key to upward mobility. Skilled trades, skilled labor, professional occupations and entrepreneurship continue to propel a growing middle class which remains strong domestically and is now growing in emerging countries like India.

Our outlook for 2026 is for stocks to continue to rise based on positive fundamentals which we believe remain intact. A key difference today is that technology leaders in AI are profitable versus the dot-com stocks of 30 years ago. We also see opportunities outside of technology, and portfolios remain well diversified. In fixed income, the 10- year U.S. Treasury has yielded in a range of 4.0%-4.6% which is approximately 1.0%- 1.5% above inflation. We anticipate little improvement in inflation and expect bonds to remain within their current range.

It is our privilege to serve you, and we look forward to working together in 2026. We wish you a prosperous and healthy new year.

Robert Magan, CFA®

Senior Vice President

Senior Wealth Management Officer

603.230.4219

Steve Smith, CFA®

Senior Vice President

Wealth Advisor/Strategist

603.230.4209

Dona G. Murray

Senior Vice President

Wealth Advisor

603.527.3936

Paul R. Zepf, CFA®

Vice President

Wealth Advisor

603.527.3234

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |