Here’s to Your Wealth – The Power of Compounding

09/01/2023

We live in a world of instant gratification. Marketing teams work with behavioral psychologists to develop ways to nudge us towards consuming now. Do you want to watch a movie? Stream it on Netflix, on any device, anywhere. Do you need a blender to bake a cake this weekend? Click that yellow button on Amazon and you’ll have it tomorrow. It’s hard to resist. Evolution has programmed us this way.

Early humans were concentrating on surviving the current day and most likely did not spend much time contemplating the future. “Unlike our ancestors who ate when they saw food because they may not have known where their next meal would come from, we don’t need to indulge whenever we see food,” (Mehta, 2022, para.7). Yet, we are so programmed, just think how hard it is to forego that donut (instant gratification) to achieve longer-term health goals.

Social media merely reinforces this behavior. Facebook, Instagram, TikTok and X (formerly Twitter) allow people to post everything they eat, buy, visit and experience. We see that they have it, and we want it. We can easily justify current consumption by saying to ourselves, “you only live once.” Just ask anyone under the age of 25 what YOLO means.

Younger people especially see the satisfaction of consuming now rather than saving for a future that seems so far away and unpredictable.

Every decision comes with a cost. When we choose to consume now, there is the actual cost of the consumption and the opportunity cost of saving/investing those dollars. The nature of compounding makes it even harder to see that opportunity cost. Early on, savers are not rewarded greatly. Years of monthly retirement plan contributions can go by and accounts barely seem to grow. However, given enough time, the power of compounding will reveal itself. I am going to provide two examples that show how the power of compounding returns can pay off greatly if you stay patient and committed to long-term goals.

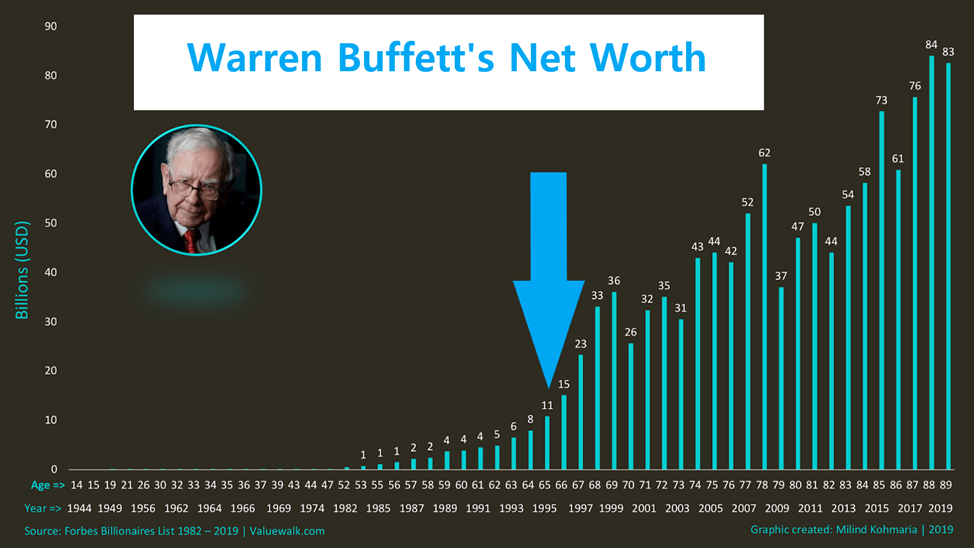

Warren Buffett is 93 years old. He began investing when he as 11 years old using money he earned from his paper route. It took over 40 years, almost half his life, to achieve a net worth of $1 billion. Over the next 40 years, his net worth grew to about $100 billion. “In fact, Buffett made more that 70% of his net worth after he was 65 years old,” (Mizrahi, 2022, para. 16). You can see this visually on the chart below:

Just look at how fast his net worth started growing in the mid 1990’s. This is not from some secret technique that he invented. It’s from simple techniques like earning investment interest on his investment interest and using dividends to buy more shares that will pay more dividends.

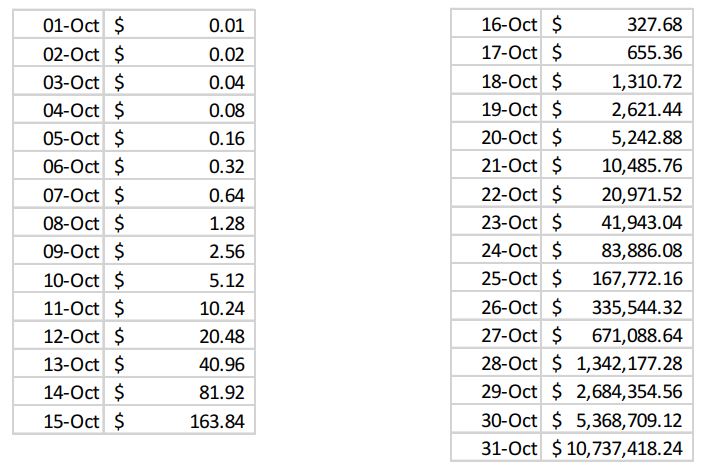

Here is another fun example that really shows the power of compounding. Let’s say on October 1st I give you a penny. On October 2nd I double the number of pennies you have, so now you have two pennies. On October 3rd I double the number of pennies your holding so now you have 4 pennies. We continue this process every day.

By October 10th, you’ll have $5.12. If you choose to not buy a cup of coffee and let me continue, you will have $163.84 on October 15th. Now, instead of spending that at a restaurant we continue the process and you have $5,242.88 by October 20th. But don’t book that vacation just yet!

Five days later on October 25th you will have $167,772.16. If you can hold on for just 6 more days, on October 31st, you will have $10,737,418.24!! You went from a penny to $10.7 million in 31 days. Remember that on day 15, you had $163. Like the Warren Buffett example above, the greatest benefits of compounding occurred towards the end of our experiment. See the chart below:

I can’t guarantee that you will achieve Warren Buffett type of returns. And your money certainly won’t double every day for 31 days. Those are just examples to show how the benefits of compounding start slow but really make a difference if you’re patient. Of course, this assumes you let your portfolio work undisturbed. As Charlie Munger, Warren Buffett’s business partner, once said, “the first rule of compounding: Never interrupt it unnecessarily.”

Younger people may not like to hear it, but that is the secret of how most people build wealth. It wasn’t from a get rich quick scheme, or a lottery ticket or inheritance. It was from being disciplined, methodical and cognizant of long-term goals. We can work with you to construct a quality portfolio. We can help you make smart decisions so your portfolio can grow over time. Still, a key factor is having the patience to let your investments work and earn for you, and that comes from discipline.

Wishing you good health and good wealth.

References:

Mehta, K. (2022, October 31). Why You Succumb To Instant Gratification – And The Easiest Way To Make Life Optimizing Choices. Forbes. https://www.forbes.com/sites/kmehta/2022/10/31/why-you-succumb-to-instant-gratification–and-the-easiest-way-to- make-life-optimizing-choices/?sh=58a09ef65d2d

Mizrahi, C. (2022, September 1). How to turn a snowball into $100 billion. Banyan Hill Publishing. https://banyanhill.com/turn-a-snowball- into-100-billion/

This material is intended for informational/educational purposes only and should not be construed as tax, legal or investment advice. We make no representation as to the completeness or accuracy of information provided at these websites. Please consult with your financial professional and/or a legal or tax professional regarding your specific situation and before making any investing decisions.

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |