Here’s to Your Wealth – Tax-Smart Giving

06/01/2023

According to Giving USA, charitable giving in the US “reached a record $485 billion in 2021,” (Beaty & Gamboa, 2022). That is good news. Donations were 4% higher than 2020 and that is great news. However, after accounting for inflation, charitable giving was actually down 0.7%. Nonprofits have been feeling the effects as incoming dollars have not kept pace with rising prices in everything from staff wages to utilities and other expenses. You may already have a charitable giving plan in place, and the organizations you support are very grateful. Or, maybe you have dabbled here and there and wish to organize your giving plan to be more impactful. Let’s explore a few different strategies that may be right for you, regardless of where you are in your philanthropic journey.

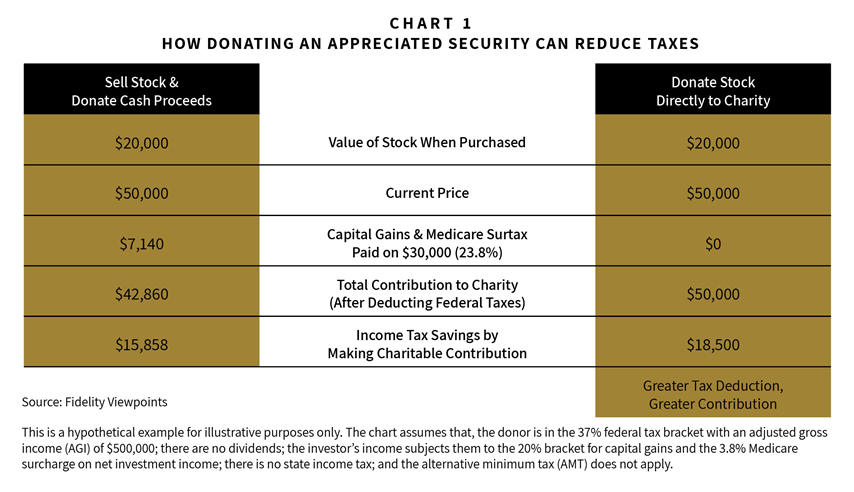

Gift appreciated assets instead of cash: Let’s assume you want to donate $50,000 (see Chart 1 below). To do this, you are considering selling stock from your portfolio and you will send a check once the trade settles. The left side of the graphic shows the result of you selling $50,000 of stock that has a $30,000 long-term capital gain. You would be liable for $7,140 in capital gains taxes. Assuming you hold that aside, the net available to donate would be $42,860 to the charity. Charitable gifts can lower your taxable income, so if you were in the 37% tax bracket, you would realize income tax savings of $15,858 ($42,860 X 37%).

However, if you gift the stock directly to the charity, you pay no capital gains tax (and neither does the charity). They get a gift of the full $50,000. Your income tax savings increases to $18,500 ($50,000 X 37%). Both you and the charity benefit more by gifting the appreciated stock.

Qualified Charitable Distribution (QCD): This strategy works if you have an IRA and you are subject to required minimum distributions (RMD). If you elect to receive the RMD and then gift the cash, the amount will be included in your adjusted gross income which might affect other tax- related items. To avoid this, while simultaneously making a charitable gift, you can instruct your IRA custodian to make a QCD. In this case, the gift amount will bypass you and go directly to the charitable organization. You get the benefit of satisfying your RMD and not increasing your adjusted gross income, while the charity gets the benefit of your generosity. QCDs are currently limited to $100,000.

Charitable Remainder Trust CRT: A CRT is an irrevocable trust which pays a non-charitable beneficiary, usually the donor or their spouse, a stream of income for life or a period of 20 years. At the end of the time period, anything left in the trust goes to a specified charity. Besides the income stream, the donor gets an immediate income tax deduction when the trust is funded (limits and rules apply).

Charitable Lead Trusts CLT: CLTs are a reverse of the CRT mentioned above. In this case, a charity gets paid an income stream for a set period. At the end of the set period, the trust terminates and any balance is transferred to designated non-charitable beneficiaries, such as family members. There are potential income, gift or estate tax benefits that are dependent on how the trust is structured.

Did you know that Bank of New Hampshire is able to serve as trustee of your charitable trust? You would have access to all the services you would expect from us including investment management and trust accounting to ensure payments go out correctly and remaining assets go to appropriate remaindermen at trust termination. We would also file the federal tax returns and send copies to the NH Charitable Trusts Unit.

There are many ways for someone to satisfy their philanthropic goals. They all come with different advantages from a tax perspective. Some methods occur in your lifetime and allow you to see your generosity being put to good use. Others, like naming a charity as a beneficiary in your estate plan, will, retirement account or life insurance policy create a wonderful legacy. You can choose on or multiple strategies, but we strongly urge you to work with your tax advisor before creating any charitable giving plan. We are always willing to work with you and your tax advisor to ensure your generosity makes a difference while maximizing tax benefits and aligning with your financial goals.

Wishing you good health and good wealth.

References:

Beaty, T., & Gamboa, G. (2022, June 21). US charitable giving hit record in 2021 but inflation looms. AP NEWS. https://apnews.com/article/inflation-covid-health-united-states-2b036519257399ac12cd1fd7f6030569

Disclaimer: Please note that I am not a tax professional, and the information I provide is for general informational purposes only. While I strive to provide accurate and up-to-date information, it is important to consult a qualified tax professional for specific advice regarding your individual tax situation. Any reliance you place on the information provided is therefore strictly at your own risk.

This material is intended for informational/educational purposes only and should not be construed as tax, legal or investment advice. We make no representation as to the completeness or accuracy of information provided at these websites. Please consult with your financial professional and/or a legal or tax professional regarding your specific situation and before making any investing decisions.

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |