Here’s to Your Wealth – Why Market Crash Predictions Don’t Matter (and What Does)

03/22/2024

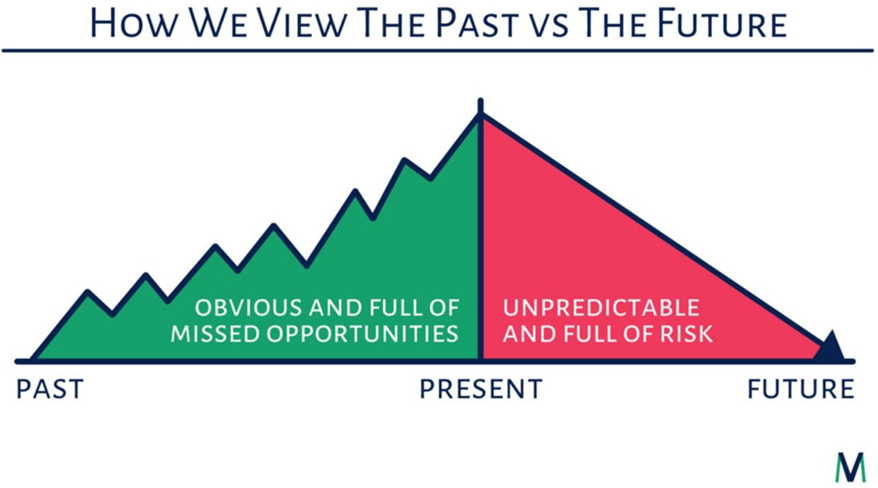

In the realm of wealth management, one often encounters numerous predictions about market crashes, recessions, and economic downturns. The intensity of these predictions from market pundits and media seem to increase as stock prices climb higher. Much like how a stopped clock is right twice a day, one who continually predicts a market crash year after year will eventually be right.

Seasoned financial writer Morgan Housel once remarked on a podcast, “the people predicting doom will always get more headlines than the people predicting prosperity.” This observation resonates in today’s landscape where sensationalism often trumps rational analysis. Pundits, driven by a desire to capture attention, frequently make dire predictions, disregarding the broader historical context. Often a quick search on Google or Amazon will show the series of books they have written over the years to prepare you for the impending crash that never occurred. While their analysis over time has been based on very solid data, their accuracy is hardly commendable.

These predictions of doom often come from learned, seasoned professionals who are very confident in their analysis and models. Housel commented on this in a recent article by observing, “if asked, ‘Why did the stock market fall 0.23% last week?’ an average person will shrug their shoulders and walk away. A very smart person will show you their yield-curve model and valuation analysis and tell you whether the performance will continue. Who do you think is more likely to be stricken by overconfidence?” (Housel, 2024). This observation underscores the dangers of overconfidence in financial analysis, particularly when attempting to forecast short-term market movements.

It’s crucial to keep in mind that while these prophets of doom are often wrong, the vast majority are never in doubt. Their confidence may be compelling, but their track record leaves much to be desired. Markets, historically, have exhibited resilience, bouncing back from downturns and ultimately trending upwards over time. In 2020, the firm 1620 Investment Advisors showed that over the last 40 years, 12-month period S&P 500 returns were positive 78% of the time, and 12% of the time there was a decline of at least 10%. This statistic serves as a sobering reminder that despite intermittent turbulence, the long-term trajectory of markets remains positive.

Indeed, attempting to time the market based on predictions of impending doom is akin to gambling with one’s financial future. After all, rising markets are also part of our history of returns and shouldn’t be ignored. As investors, it’s imperative to adopt a disciplined approach grounded in sound principles rather than succumbing to the allure of sensational forecasts. Diversification, asset allocation, and a long-term perspective are the cornerstones of a robust investment strategy.

In the face of short-term volatility and sensational headlines, it’s essential to remain steadfast in adhering to a long-term plan. Reacting impulsively to market fluctuations can often lead to suboptimal outcomes and erode wealth over time. As Warren Buffett famously quipped, “The stock market is designed to transfer money from the active to the patient.”

Remember, you only capture the long-term stock market average if you buy and hold your investments, refraining from frequent trading. (Royal & O’Shea, 2018). Trading in and out of investments can lead to increased transaction costs, taxes, and emotional stress, ultimately undermining your long-term financial goals.

While it’s natural to be swayed by sensational headlines of market predictions, we must exercise caution and discernment. The next time you encounter dire forecasts of market crashes and recessions, remember the analogy of the stopped clock. Instead of reacting impulsively, stay the course and adhere to your carefully crafted investment plan.

As always, we remain committed to guiding you through the complexities of wealth management with prudence and expertise.

Wishing you good health and good wealth.

References:

1620 IA. (2020, December 29). Stock returns over different time horizons. https://www.1620ia.com/post/stock-returns-over-different-time-horizons

Housel, M. (2024, March 3). The dumber side of smart people. Collab Fund. https://collabfund.com/blog/the-dumber-side-of- smart-people/

Isola, T. (2024, March 2). It’s time to taste what you most fear…….When is my retirement? A Teachable Moment – Educating teachers about money. https://tonyisola.com/2024/03/its-time-to-taste-what-you-most-fear-when-is-my-retirement/

Royal, J., & O’Shea, A. (2018, March 1). What is the average stock market return? NerdWallet. https://www.nerdwallet.com/article/investing/average-stock-market-return

This material is intended for informational/educational purposes only and should not be construed as tax, legal or investment advice. We make no representation as to the completeness or accuracy of information provided at these websites. Please consult with your financial professional and/or a legal or tax professional regarding your specific situation and before making any investing decisions.

Securities and Insurance Products are:

| Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not a Deposit | Not Insured by any Government Agency |