Digital Innovation

What does the bank of tomorrow look like?

Let us show you.

New technologies have changed the way we bank—and at Bank of New Hampshire, we’re proud to put that innovation right at your fingertips. Ready to raise your expectations?

Banking might seem like a traditional industry…

…but it has always innovated. From bank notes to checkbooks, to credit and debit cards, to ATM and video drive-ups, to online banking and mobile banking, the banking industry has transformed over the years. The current pace of change, however, is at another level, and BNH is continuing to evaluate the latest technological innovations to better serve our customers, improve their financial health and make everyone’s daily processes more efficient.

Our digital innovations allow you to take full control of your finances. You can learn how to create a budget, implement helpful budgeting tools, get access to the best investment app and use an amazing free personal financial management tool – all built just for BNH customers.

Innovations to Improve Your BNH Experience:

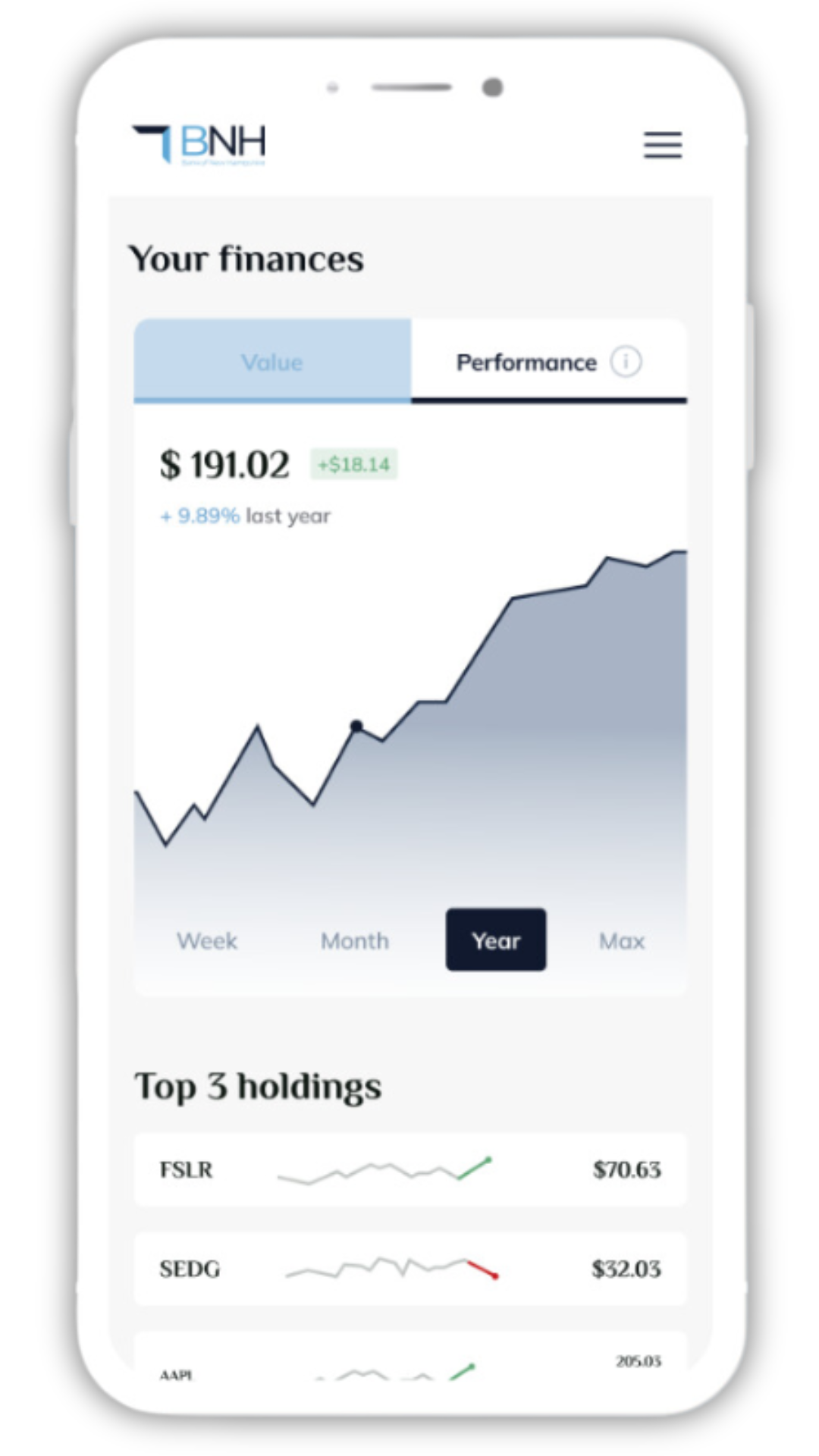

At BNH, we believe in empowering you to achieve your financial goals with ease. So we took the complexity out of investing, by incorporating an innovative digital investing solution into our Online and Mobile Banking. You can start your investment journey with as little as $10. There are three investment portfolios available:

Self-Directed Portfolio – You will start with an empty portfolio, where you can pick your own individual stocks, bonds, and ETFs.

Hybrid Portfolio – Answer a few questions to get your personalized portfolio. You’ll then have the freedom to add or remove stocks, bonds, and ETFs.

Pre-made Portfolio – Choose from our 3 pre-made diversified portfolios, offering exposure to both bonds and stocks.

Click the ‘Investment’ button in the left-hand navigation menu of BNH Online or Mobile Banking to start exploring the platform and take the next step towards securing your financial future.

Third party fees may apply. Securities and Insurance Products are: Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit and Not Insured by any Government Agency.

Wouldn’t it be great to monitor your credit cards, loans, 401k, savings and more – and do it all from your desktop or phone? With BNH, you can! We understand how important it is for you to have a clear picture of your financial health and we’re ready to help.

With our Personal Financial Management (PFM) tools, you can aggregate all of your accounts, from anywhere, into your BNH Online and Mobile Banking, for a wholistic view of your finances. When you log into your BNH Online Banking, you will see a button on the top of your screen, labeled “Get Started.”

Use our PFM tools to:

- Budget

- Categorize spending

- Visualize trends and cash flow

- Monitor debit

- Realize net worth

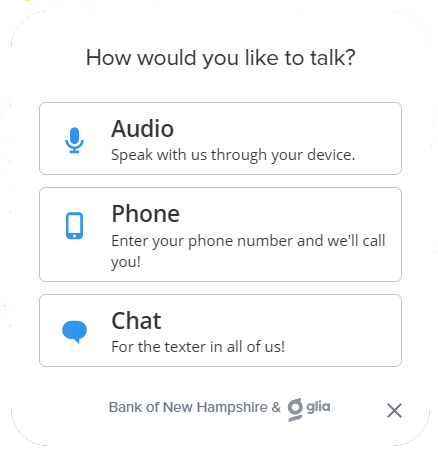

Meet Winni, your AI (artificial intelligence) powered virtual assistant designed to help you with basic banking inquiries!

Whether you need to find our routing number, locate an office or ATM, reset your password, submit a fraud claim, or ask a general question about our products and services, Winni is available 24/7 to assist you. Simply click the “Let’s Talk” button to start chatting with Winni. For optimal results, please phrase your questions concisely. The more customers interact with Winni, the more Winni will learn and expand our knowledge base to better assist you!

For more complex requests that require human interaction, simply type “Live Person” in the chat during BNH’s regular business hours, and you’ll be connected with a member of our Customer Service Center.

We also offer other flexible communication options. From the “Let’s Talk” bubble, you can select “Audio” to speak with us via your computer or mobile device. If you prefer a phone call, select “Phone”, enter your phone number, and we’ll give you a call right away. With the addition of Winni to our incredible team of people, you’ll never be without assistance, no matter when or where you need it!

Over the past few years, BNH has been transitioning our drive-ups to have video at each of the lanes. Video allows us to have a more private conversations with our customers and allows us to better identify them as well. With the popularity of SUV & Trucks, the 2nd and 3rd lanes were often obscured by the vehicle in the first lane.

On the inside we have improved efficiencies as every Bank Service Representative in the office has the ability to complete drive-up transactions resulting in quicker processing times.

Bank of New Hampshire is proud to announce that we are one of the first financial institutions in the country to offer an eco-friendly, biodegradable debit card! While the Polyvinyl Chloride (PVC) used to make traditional debit cards takes approximately four-hundred years to break down, PLA card biodegrades in approximately six months*. At Bank of New Hampshire, we are committed to sustainability, and we care about the environment – just like you!

*As certified against EN13432 under the right conditions.

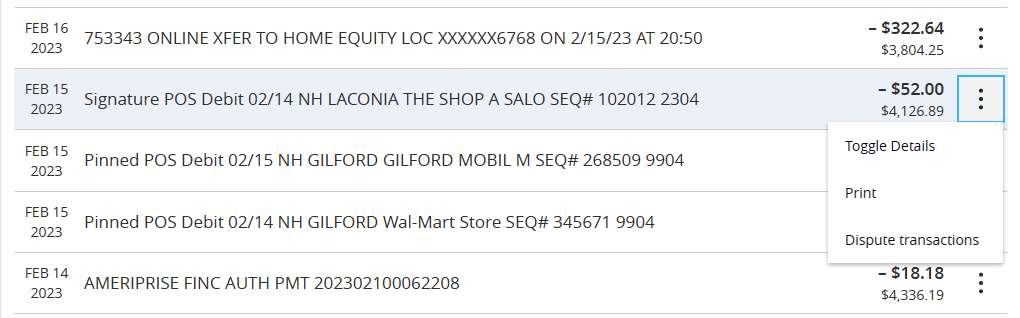

You have the ability to dispute an unauthorized debit card or electronic debit (ACH) transaction with Electronic Funds Transfer Disputes directly from within Online and Mobile Banking. Just click on the three dots next to the transaction that you want to dispute and follow the prompts.

BNH partnered with Glia to provide our customers with the ability to chat, do an audio call or request a call back when visiting our website, doing online or mobile banking and when opening an account online. This provides our customer with the ability to have the human touch where it may be needed when using our digital channels.

Future enhancements will include video interactions.

Stay informed and in control of real-time alerts that help you control exactly what’s happening with your money and watch for suspicious activity in real-time.

Keeping you protected from fraud is important to us. Our debit card fraud alerts is a complimentary service included with your Bank of New Hampshire debit card that notifies you when suspicious activity occurs on your card.

With BNH Debit by Design, you can show off your family, your pets or the amazing summer trip you went on! With Debit by Design you can customize almost any image on your BNH debit card. Express yourself and create a personal connection to the way you spend your money. Your debit card will be a perfect conversation starter to show off!

And it’s FREE!*

*Debit by Design is free for Bank of New Hampshire Personal, Prestige and Business account holders with an active minimum balance. Debit by Design terms and conditions apply.

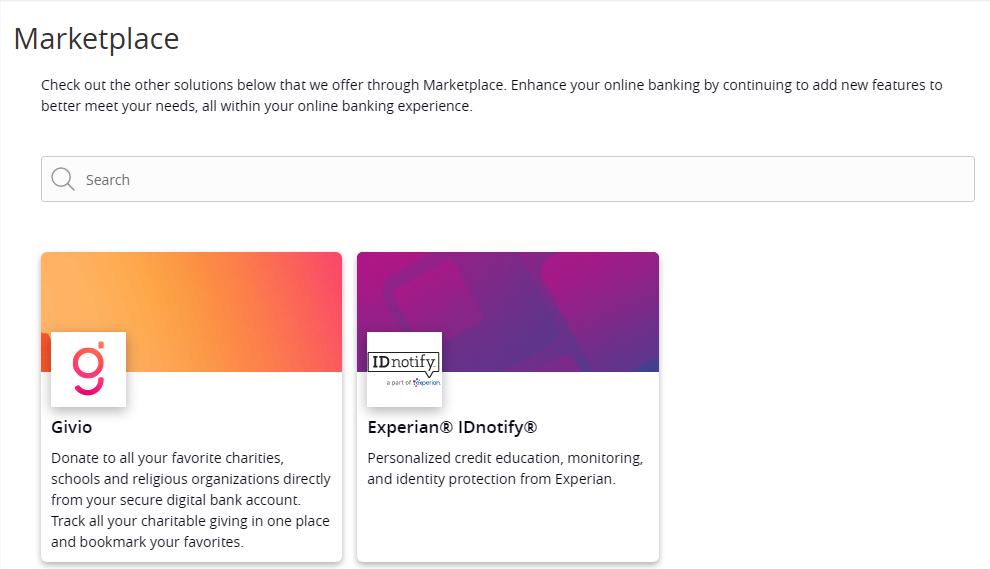

Expand the functionality of your Online Banking with Marketplace, your one-stop shop for financial apps. Similar to apps for your smartphone, the Marketplace allows you to select from a set of trusted third-party apps that help you manage your personal finances, run your business, and more – all in one convenient location.

Still not signed up?

Get Bank of New Hampshire online banking today!